Tensiunile geopolitice, inflatia ridicata, problemele legate de lantul de aprovizionare, cresterea ratelor dobanzilor - o multitudine de factori influenteaza modificarile preturilor pe pietele financiare. O strategie de investitii si o abodare obiectiva sunt necesare pentru a face fata acestor schimbari. onemarket Allianz Conservative Multi-Asset Fund se adreseaza in primul rand investitorilor conservatori.

| Fondul in detaliu | Proces de investitii | Clasa de investitii | Flyer | KID | Factsheet |

Fondul in detaliu

onemarkets Allianz Conservative Multi-Asset Fund este un fond multi-active administrat in mod activ. Acesta se bazeaza pe o abordare sistematica pentru a surprinde ciclul pietei si tendintele pe termen mediu. In plus, se realizeaza o evaluare fundamentala a pietelor globale si un control constant al riscului. Investitiile se fac numai in titluri de valoare care indeplinesc criteriile SRI (Sustainable and Responsible Investing/Investitii Social Responsabile) definite, mai exact investitii durabile si responsabile.

- Obligatiuni: Durata de la - 2 la + 10 ani

- Expunere la actiuni: 0% pana la 30%.

Fondul ofera oportunitati suplimentare prin investitii in investitii alternative (de exemplu, obligatiuni indexate la inflatie, REIT-uri (fonduri de investitii imobiliare), capital privat (societati de capital privat), alternative (investitii alternative) etc.), piete emergente (pana la 25%), marfuri (pana la 20%) si obligatiuni cu randament ridicat (pana la 15%).

Allianz Global Investors este unul dintre cei mai importanti administratori de active la nivel mondial, cu peste 500 de miliarde de euro in activele gestionate de clienti si peste 300 de fonduri publice. Strategiile conform criteriilor SRI (Investitii Social Responsabile), cel mai bun din clasa1, sunt concepute pentru a oferi atat randamente financiare, cat si un impact social/de mediu pozitiv.

Pentru mai multe detalii:

Descarca flyerul (PDF)

1Abordarea SRI (Investitii Social Responsabile) best-in-class (cel mai bun din calsa) cuprinde strategii care sunt concepute pentru a oferi atat randamente financiare, cat si un impact social/de mediu pozitiv. Abordarea utilizeaza metodologia de rating proprie AllianzGI pentru a identifica companiile de top in ceea ce priveste sustenabilitatea in sectoarele lor respective. Sursa: Allianz Global Investors

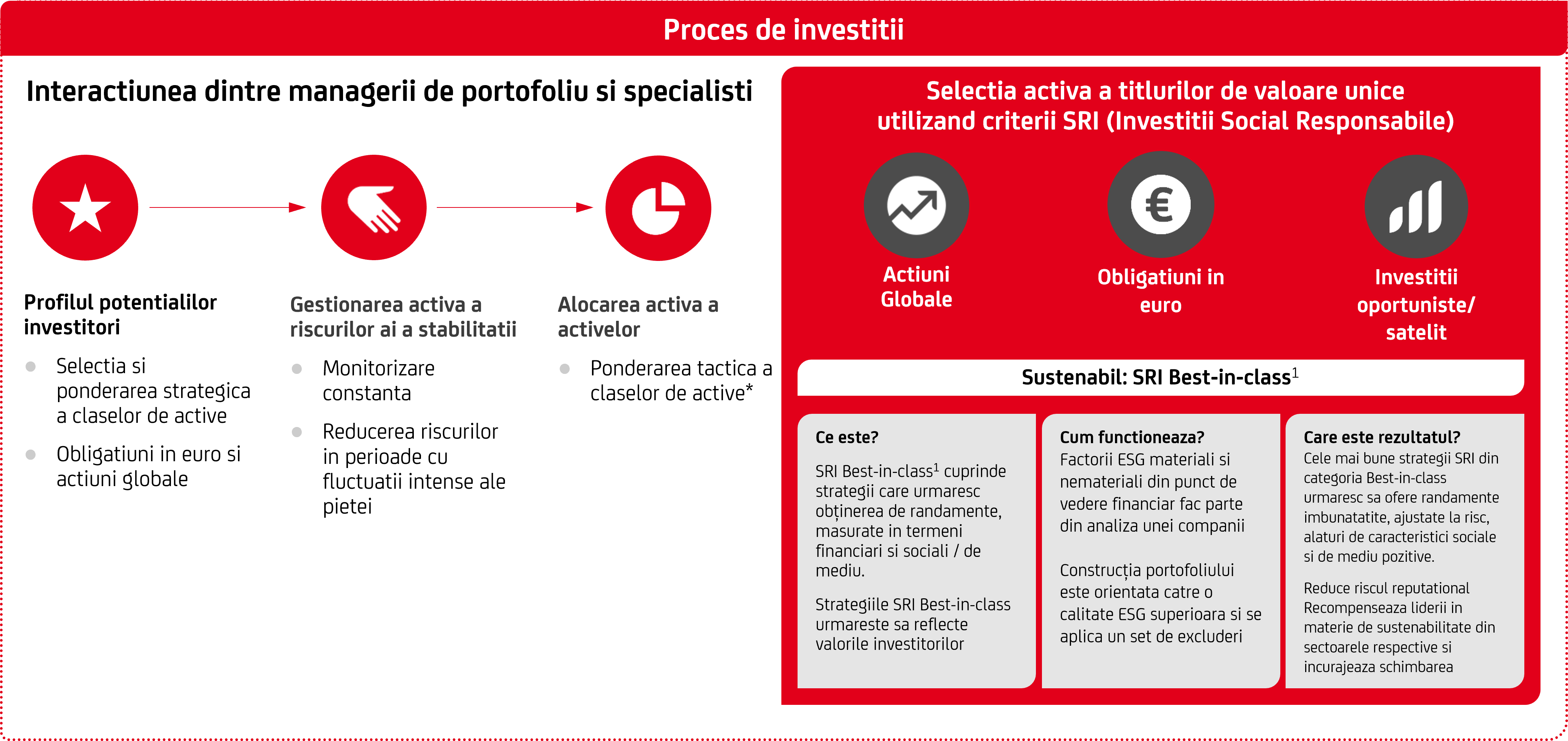

Proces de investitii

Sursa: Allianz Global Investors. Date la ianuarie 2024. Descrierea criteriilor aplicabile procesului de investitii in mai multe active are doar scop ilustrativ. Nu reprezinta o indicatie a rezultatelor viitoare.

Performanta strategiei nu este garantata, iar pierderile raman posibile. Aceasta este doar cu titlu orientativ ai nu reprezinta o indicaaie a alocarii viitoare.

1Abordarea SRI Best-In-Class cuprinde strategii care urmaresc obtinerea de randamente masurate atat in termeni financiari, cat si in termeni sociali si/sau de mediu. Abordarea identifica liderii in materie de sustenabilitate in sectoarele respective, pe baza metodologiei de rating proprie AllianzGI.

* Grad de investitie de pana la 125%.

Clasa de investitii pentru onemarkets Allianz Conservative Multi-Asset Fund

| onemarkets Allianz Conservative Multi-Asset Fund M (investitori de retail, cu acumulare; investitie initiala minima: 200 EURO) |

LU2595019543 | Catre produs |

Contact

InfoCenter 24/7: *2020 (apel cu tarif normal in retelele mobile) si +40 21 200 2020 (apel cu tarif normal in toate retelele)

email: infocenter@unicredit.ro

onemarkets Fund reprezinta o platforma de fonduri umbrela UniCredit O.P.C.V.M. (Organisme de plasament colectiv in valori mobiliare), constituita ca societate de investitii cu capital variabil, societate anonima, administrata de Structured Invest S.A.

ACEASTA ESTE O COMUNICARE DE TIP COMERCIAL. Inainte de a lua orice decizie de investitie, te rugam sa citesti Documentul cu informatii cheie (KID), in limba locala, si Propectul onemarkets Fund (denumit in continuare "Fondul"), disponibil in limba engleza, versiunea in limba engleza reprezentand versiunea obligatorie din punct de vedere juridic pentru Societatea de Administrare, care pot fi obtinute gratuit pe suport de hartie la cererea investitorului si la sediul Distribuitorului. Suplimentar, pe https://www.structuredinvest.lu/ sunt disponibile actul constitutiv al Fondului si cele mai recente rapoarte anuale si rapoarte semestriale, obligatorie din punct de vedere juridic.

Valoarea actiunilor si a profitului obtinut in urma unei investitii in Fond ar putea scadea sau creste, in functie de conditiile de piata. Subfondul nu ofera nicio garantie de rentabilitate.

Se atrage atentia investitorilor asupra faptului ca Societatea de administrare relevanta poate decide sa intrerupa aranjamentele pe care le-a facut pentru distribuirea actiunilor fondurilor sale in conformitate cu Directiva 2009/65/CE.